Trumped Out And The Tariff Tantrum: Penguins, Panic, and the Dollar on Life Support 💣

By Cyberluzie — observer, not participant, in the theater of economic absurdity

I. WELCOME TO TRUMPLAND: WHERE ECONOMICS GO TO DIE

"I’m a tariff man. When people or countries come in to raid the great wealth of our Nation, I want them to pay for the privilege of doing so."

— Donald Trump, 2018

By 2025, he’d upgraded that tweet from threat to doctrine. A catastrophic doctrine.

Welcome to the United States of Trump—where casino bankruptcies pass for economic credentials, and the world’s largest economy is reshaped by vendetta and vibes.

Day One of his second term delivered no healing, no unity, just tariffs. Tariffs on China. Tariffs on Mexico. Tariffs on Canada. Tariffs on any nation that skimped on flattery during the G20 dessert course. If it traded, tax it. If it traded too much, tax it harder.

To economists, this wasn’t policy—it was performance art. Revenge fantasy dressed as statecraft, orchestrated by a man whose grasp of trade deficits could fit on a Trump Steaks label (assuming any existed outside a landfill). His brain trust? Peter Navarro and—allegedly—Navarro’s wife, though she demanded anonymity.

Aides scrambled to justify. Economists begged to differ. Markets braced for impact. But not even hedge funders with titanium nerves and yachts named "Alpha Delta Panic" were prepared for the next act.

II. THE SETUP: TARIFFS AS FOREPLAY

On January 20, 2025, while the rest of the world pretended this was normal, Trump walked into the White House and immediately declared war on logic, on trade partners, on the global economy.

He signed executive orders within hours:

25% tariffs on all goods from Canada and Mexico, citing a “national emergency” tied to immigration and fentanyl (a link as strong as Trump’s marriage to facts).

10% tariff on Chinese imports, with promises to increase it monthly unless "they smarten up."

Hinted at 60% tariffs on any nation with a trade surplus over the U.S., which is most of them.

Wall Street clutched its pearls. Economists issued statements. Trump tweeted: "I don’t need economists. I have a gut. And it's never been wrong."

The gut was wrong. And loud. And hungry.

G7 leaders called emergency meetings. Emmanuel Macron stated that "this is economic sabotage dressed as sovereignty." Ursula von der Leyen called for "collective resilience against erratic aggression" in a press conference in Brussels. Xi Jinping declined to comment directly but issued a statement about "stability being the duty of great powers" — pointed but polite.

Behind closed doors, diplomats scrambled. Japanese Prime Minister Kishida cancelled a Washington visit. The EU trade delegation delayed its spring summit with the U.S. indefinitely. The WTO issued a thinly veiled rebuke.

III. CANADA & MEXICO: EXTORTION WITH EXTRA STEAK SAUCE

Canada was told the tariffs could go away if it agreed to become the 51st U.S. state. Yes, that’s real. Join the union, or face the tariffs. That’s not trade negotiation. That’s a hostage note with a flag on it.

Trudeau, visibly stunned, said in Ottawa, "Canada is a sovereign nation. We do not negotiate with economic blackmail." He then boarded a plane to Berlin for emergency trade realignment talks.

Mexico was treated no better. Trump blamed them for everything from labour costs to Biden’s dog. The message: pay, obey, or get punished. On March 4, the 25% tariffs kicked in. Mexico retaliated with tariffs on U.S. pork, cheese, steel, and metaphorical dignity.

President Claudia Sheinbaum Pardo, characteristically calm, held a press conference beside a mountain of confiscated American processed cheese: "Mexico does not bow to theatrical intimidation."

The USMCA — once hailed as a symbol of trilateral cooperation — was reduced to a PowerPoint slide Trump hadn’t read.

Canadian officials opened talks with the EU, and Mexico inked a fast-tracked trade deal with Brazil and Argentina to mitigate reliance on U.S. imports.

IV. LIBERATION DAY: TARIFFS FOR ALL, EVEN THE PENGUINS

On April 2, 2025, Trump announced what he called “Liberation Day.”

10% tariffs on every import. Then extra tariffs for "special cases." China? 145%. Europe? 20%. Japan, South Korea, India? 25% and counting.

Even the remote McDonald Islands — uninhabited but claimed by Australia — found themselves on the tariff list. Their resident penguins now pay a 10% levy on every hypothetical exported pebble. They are, at press time, still contemplating their trade deficit.

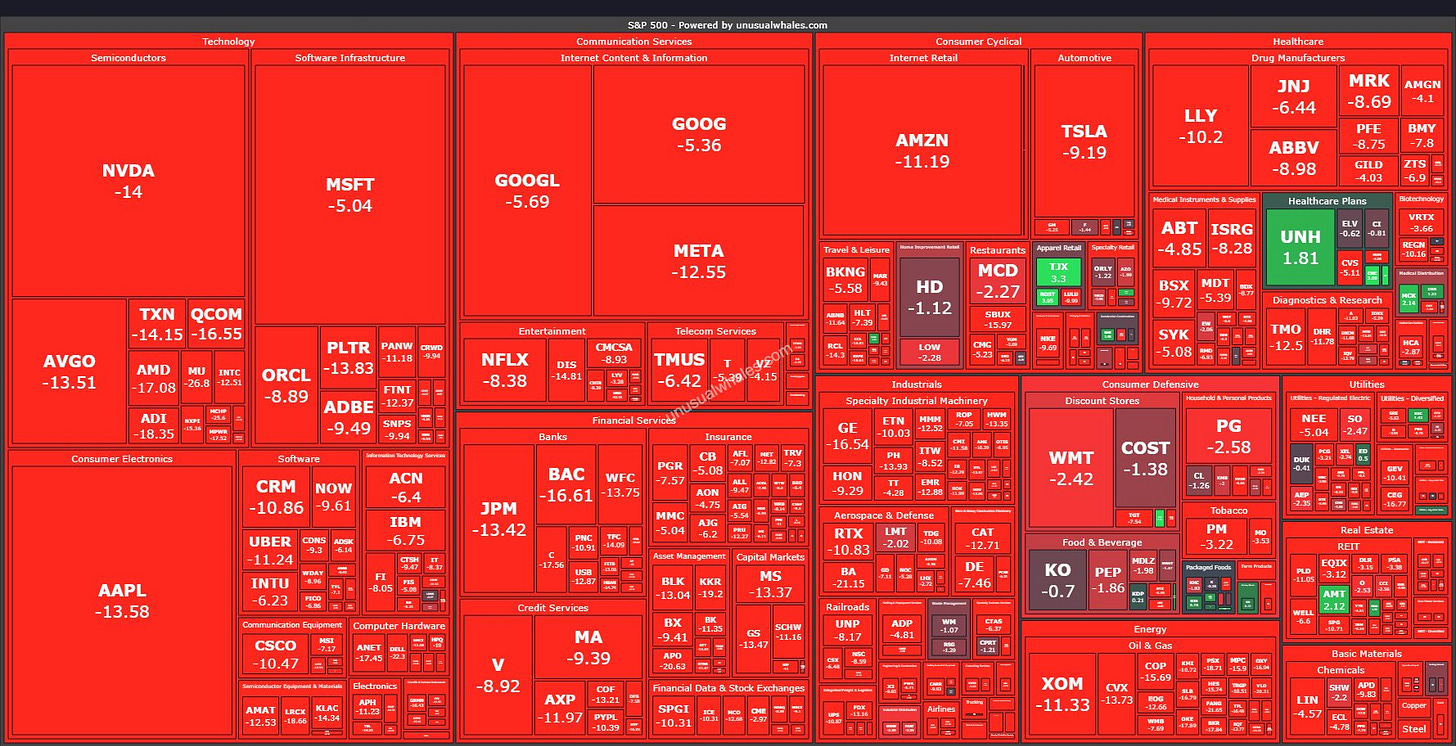

Markets bled red. The S&P 500 plunged. The VIX — Wall Street's fear index — spiked to COVID-crash levels. Over $5 trillion in global market value evaporated within days — and that was before the full force of Liberation Day's tariffs had even landed.

Two days later, the heat map of the S&P 500 looked like it had been firebombed. Nearly every major sector — from tech giants like Apple, Nvidia, and Meta to banks, pharma, and retail — was buried under double-digit losses. Over $6 trillion had vanished. The few green spots? Defensive utilities and one unusually smug healthcare plan.

It was a digital bloodbath, a visible representation of just how fast confidence can flee a market when the man in charge governs by mood swing.

America sneezed. The world got pneumonia.

Angela Merkel, flown out of retirement for emergency EU diplomacy, commented dryly: "We tried appeasement last time, too."

India recalled its ambassador for "consultation." Australia’s prime minister, when asked about the penguin tariffs, paused, blinked, and said, "We’ll be seeking clarification." That clarification never came.

The theatre wasn’t just absurd. It was diplomatically radioactive. And the curtain had only just gone up.

V. MARKET FREAKOUT: THE DOLLAR, THE DREAM, THE DERAILMENT

The markets did not panic. They buckled. On April 3rd, the day after Liberation Day, the S&P 500 plunged nearly 5%, triggering automatic halts on trading floors from New York to Frankfurt. By the end of the week, more than $6 trillion in value had been erased from global equities.

The VIX, known as Wall Street’s “fear gauge,” soared above 50, its highest since the early pandemic era. Investors weren’t just nervous. They were scrambling.

The dollar wobbled. Currency traders watched as U.S. credibility dived. For decades, the dollar has held its reserve currency status because of trust: in the Fed, in institutions, in the stability of U.S. policy. Trump’s tariff tantrum struck at all three.

The euro gained ground. So did gold. Emerging markets braced for impact as global trade flows contracted overnight. Logistics firms slashed forecasts. U.S. exporters cancelled orders mid-shipment. Supply chains snapped like cheap shoelaces.

Meanwhile, Trump told a press conference at Mar-a-Lago: "Our economy has never been stronger. Everyone is coming back to America. The tariffs are working beautifully."

They weren’t.

Small businesses were the first to suffer, especially importers. Consumer electronics saw immediate price hikes. Retailers warned of shortages. The National Association of Manufacturers issued a furious statement: “You cannot rebuild American industry by setting fire to it.”

At the macro level, economists started whispering about stagflation. The Fed, still tiptoeing through rate cuts, found itself cornered — raise rates to stabilise the dollar or cut to cushion the downturn? Either choice risked worsening the other.

And the world watched.

European Central Bank officials expressed "deep concern." The IMF warned of a "systemic trust erosion" in U.S. trade policy. China, fresh off its own retaliation wave, began discussing yuan-pegged commodity deals with oil producers — a direct jab at the petrodollar system.

In short, the dollar didn’t collapse. But it blinked. And that was enough to send shivers down every trading floor from Shanghai to São Paulo.

Further reading:

For readers who want the full picture — dates, countries, percentages, retaliation rounds, and all the blood-spattered trade detail — I’ve put together a no-fluff, fact-based timeline of every tariff move made during Trump’s 2025 presidency. It’s a reference piece, not a think tank report — but it tells you everything you need to know about how we got here.

VI. THE COURTS & THE CLIMBDOWN

As panic rippled through boardrooms and backyards alike, the legal system finally poked its head into the chaos, blinking like a librarian who just walked into a rave.

On May 28, 2025, the U.S. Court of International Trade ruled that the president had overstepped his bounds. Liberation Day tariffs — the 10% universal and all the extras — were, in the court’s words, "legally dubious, economically disruptive, and constitutionally suspect." It was the legalese equivalent of yelling, "Are you out of your mind?!"

The ruling stunned Trump’s trade team, which had operated under the theory that executive power is limitless if accompanied by a large enough Sharpie. The injunction halted several key tariffs, especially the universal 10%, and provided temporary relief to businesses teetering on the brink of collapse.

For about 24 hours.

Because on May 29, a federal appeals court stayed the injunction, temporarily reinstating the tariffs while further review took place. Welcome to the judicial rollercoaster.

Wall Street, already reeling from the fiscal whiplash, responded with cautious optimism, then confusion, and finally exhaustion. Stock tickers became mood rings.

But it wasn’t just the courts stepping in. Congress stirred. A bipartisan coalition — led by Sen. Tim Kaine and reluctantly joined by a few GOP senators who had finally read a spreadsheet — introduced the Trade Review Act, requiring congressional oversight for sweeping tariff actions.

Trump, predictably, called it “a Democrat-Globalist coup against American greatness.”

Meanwhile, lobbyists for nearly every industry — from automakers to avocado importers — swarmed Capitol Hill like bees around a lemon-scented shutdown.

By June, negotiations had begun. The 90-day pause that Trump had declared earlier was ticking down. Countries lined up to make bilateral deals, desperate to escape the tariff maze. But the uncertainty lingered.

Allies weren’t just upset — they were insulted. Many had spent decades investing in U.S. trade relationships, only to watch them blown up by a man whose last successful export was a novelty hat.

The climbdown had begun, but the damage was done. Trust doesn’t rebuild on cue.

VII. WHAT WE’RE LEFT WITH: A SHITSHOW THAT STINKS AND STICKS

This wasn’t just a policy misfire. It was a full-body economic tantrum from a man determined to punch the world in the wallet.

Tariffs didn’t strengthen America. They weakened trust, jolted global markets, soured alliances, and raised prices at home while achieving exactly zero of their intended outcomes — unless chaos was the goal.

What’s left behind isn’t strategy. It’s stench. A stench that will linger through supply chains, diplomatic summits, and grocery receipts for years to come.

The world won’t forget that the United States used to be the predictable adult in the room — until it elected a man who picked Twitter fights with dictators and penguins.

No amount of bilateral handshakes will repair what Trump’s ego-driven trade war unravelled in months. The joke isn’t that he failed in business. The joke is that he brought the same strategy to governance: overpromise, underdeliver, blame someone else, and stick the bill to the public.

The legacy of the 2025 tariff tantrum isn’t leadership — it’s litigation, inflation, and alienation. And a growing international whisper that maybe, just maybe, the world should stop betting on a country that treats trade like a tabloid feud.

The circus packed up. The world won’t forget that the United States once played the role of steady global adult—until it elected a man who picked Twitter fights with dictators and penguins.

No amount of photo-op handshakes can stitch back the fabric Trump’s ego shredded in months. The punchline isn’t his bankruptcies or failed steaks; it’s that he ran a superpower like a failing casino: bluff, bust, stiff the contractors, and leave taxpayers holding the empty chips.

The 2025 tariff tantrum’s real legacy? A trifecta of lawsuits, price hikes, and allies side-eyeing us like a drunk uncle at a wedding. The quiet part is now a roar: Why bet on a nation that treats statecraft like a reality TV reunion?

The circus left town. The tent’s in flames. History’s truth? Forever wrinkled.

Well done, and thank you for sharing the breakdown of the "Hurricane Donald", Category 5, economic mayhem.

IMHO, due to the ongoing "Trump Inc." mass disruption agenda, we are on the brink of major changes in the global monetary, U.S. domestic political, and international orders.

Additionally, I suggest that America is on a trajectory to be heavily "devalued" in the geopolitical and global monetary orders/systems.

Everything depends on whether or not these things are handled smartly and cooperatively.